property tax assistance program illinois

Districts must apply annually if they wish to be considered for the future grant cycles. And there is no money to pay it said Karpf.

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

The Affordable Housing Special Assessment Program incentivizes the rehabilitation and new construction of multi-family residential properties to create and maintain affordable housing.

. The Illinois Homeowner Assistance Fund ILHAF is a federally funded program dedicated to assisting homeowners who are at risk of default foreclosure or displacement as result of a financial hardship caused by the COVID-19 pandemic. The program will provide low to moderate income homeowners in Illinois a zero percent interest loan that needs to be used to pay their housing expenses such as their mortgage property taxes insurance and other expenses. A phone bank Thursday from 3 pm.

A lawyer may be able to help a homeowner enter into a payment program. Senior Citizens and Disabled Persons Property Tax Relief and Pharmaceutical Assistance The Circuit Breaker Program -Provides property tax relief and pharmaceutical assistance to. You may qualify for a senior freeze if you are.

Content updated daily for property tax relief illinois. The money is there. Most states provide low income families with free advice as part of the federal government funded Legal Services Corporation LSC.

Aand information on financial assistance programs for elderly Illinois residents is available here. 31 rows Purpose of the Property Tax Relief Program. Illinois Property Tax Assistance Program is available for property owners who need help today.

At that median price your down payment options might fall between. Ramps grab bars widening doorways and other improvements to enhance the independence of individuals with disabilities. This program establishes assessment reductions for multifamily rental developments subjected to certain rent tenant income and related restrictions.

Available here The Circuit Breaker Property Tax Relief program provides rebates to qualified seniors for rent property taxes or nursing home charges. Freeze your home assessed. The Property Tax Relief Grant PTRG is a one year grant program.

Senior Citizens Real Estate Tax Deferral Program This program allows persons 65 years of age and older to defer all or part of the real estate taxes and special assessments up to a maximum of 5000 on their principal residences. The Senior Citizen Real Estate Tax Deferral program is a tax-relief program that works like a loan. Own and occupy a property.

Call us today to find out if you qualify for one of our progra. Your household income from all sources for the prior year must be below 55000. A new law in the Property Tax Code 35 ILCS 20010-23 will provide a property tax break to veterans and persons with disabilities who make accessibility improvements to their residences.

Additional grant programs and access to loans can assist your business with working capital machinery and equipment land acquisition building construction and public. The Illinois Department of Revenue does not administer property tax. Over 60 years old.

Check Your Eligibility Today. If you are a taxpayer and would like more information or forms please contact your local county officials. To see if you qualify give us a call today at 312-626-9701 or fill out the form below to have one of our representatives give you a call.

Mortgage Relief Program is Giving 3708 Back to Homeowners. That was down 31 year over year. Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

Any payments made on or before October 1 for property tax second installments will be considered filed and paid on time by Cook County Treasurer Maria Pappas. It is managed by the local governments including cities counties and taxing districts. Check Your Eligibility Today.

Ad This is the newest place to search delivering top results from across the web. If you are a renter in Illinois and are behind on rent due to COVID-19 you may be eligible for up to 25000 and 18 months of emergency rental payments. Under the proposed relief ordinance interest penalties for late payments of the second installment of property taxes which are normally due August 3 will now be postponed until October 1.

A property tax freeze for seniors is a type of property tax reimbursement that will put a stop to the increase of your property tax bills. Accessibility improvements may include. Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check.

However please note that beginning FY 20 any recipient of the PTRG will need to file the abatement for 2 years. The money can be used by the client of the. The following is a list of programs offered by the State of Illinois to its senior citizens.

Another possible source of assistance in dealing with back property taxes may be a free pro-bono attorney. The treasurers office has 76 million in property tax refunds and 46 million in property tax exemptions. Mortgage Relief Program is Giving 3708 Back to Homeowners.

If so you may qualify for a state loan of up 5000 to pay current property tax bills. Homeowners with household incomes less than 150 of the Area Median Income. The Illinois Rental Payment Program ILRPP provides financial assistance for rent to income-eligible Illinois renters and their landlords who have been impacted by the COVID-19 pandemic.

Illinois offers a competitive range of incentives for locating and expanding your business including tax credits and exemptions that encourage business growth and job creation. The Property Tax Appeal Board PTAB or Board is a quasi-judicial body made up of five Board Members appointed by the Governor with the advice and consent of the Senate and a professional staff to aid the Board. Vaccines protect you and.

It allows qualified seniors to defer a maximum of 5000 per tax year this includes 1st and 2nd installments on their primary home. The program requirements include. Senior citizen tax deferral There is also a loan program to help homeowners who are 65 by June 1 of the relevant tax year.

The COVID-19 vaccines are safe and effective and are an important tool for ending the global pandemic. The loan from the State of Illinois is paid when the property is sold or upon the death of the participant. We have funds available for delinquent taxes on a first come first served basis and assistance can only be given to one property per Illinois homeowner.

The program is administered by the Illinois Housing Development Authority IHDA which will begin accepting applications from homeowners to eliminate or reduce past-due mortgage and property tax. Their next payment is due June 1. If you apply and are qualified for this property tax program it will.

The PTAB was created in 1967 to provide an unbiased forum for taxpayers and taxing bodies outside of Cook County that are. Property taxes are due in June and September. Overview of the Illinois Hardest Hit Fund known as the Emergency Loan Program.

The Karpfs pay 10000 a year in property taxes. Senior Citizens Property Tax AssistanceSenior Freeze.

Property Tax City Of Decatur Il

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Governor Pritzker Presents 2023 Budget Including Property Tax Rebates Chicago Association Of Realtors

Cook County Property Tax Bill How To Read Kensington Chicago

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

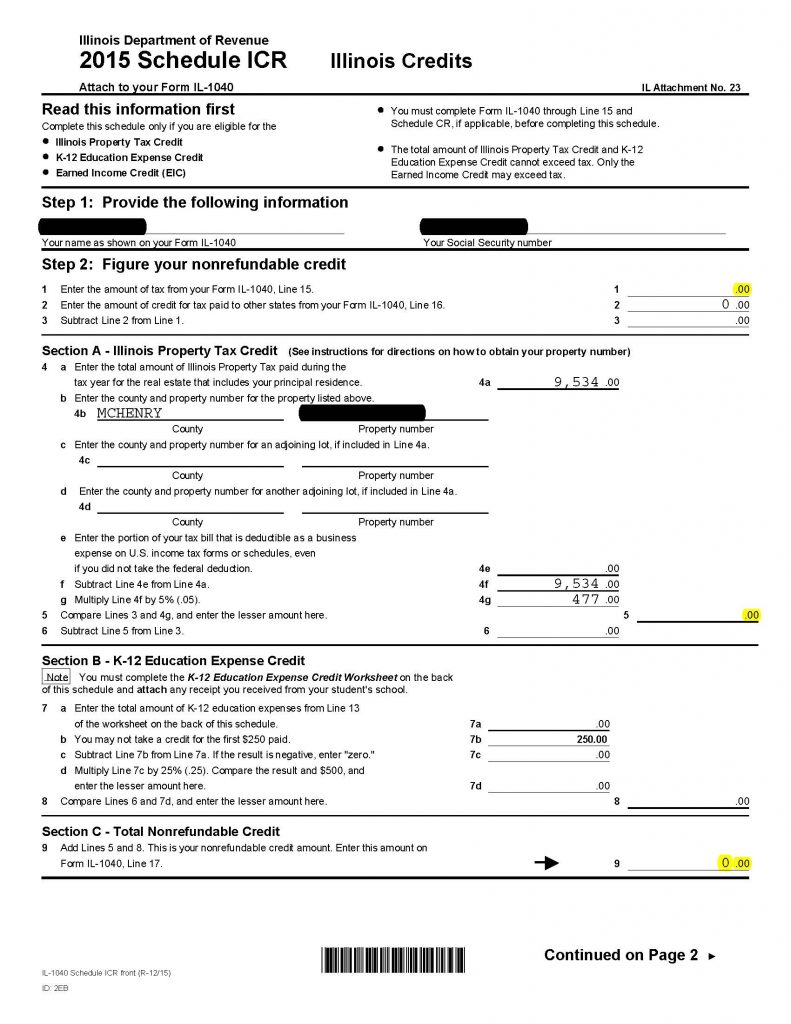

Deducting Property Taxes H R Block

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Providing Some Property Tax Relief For Low Income Seniors

Property Tax City Of Decatur Il

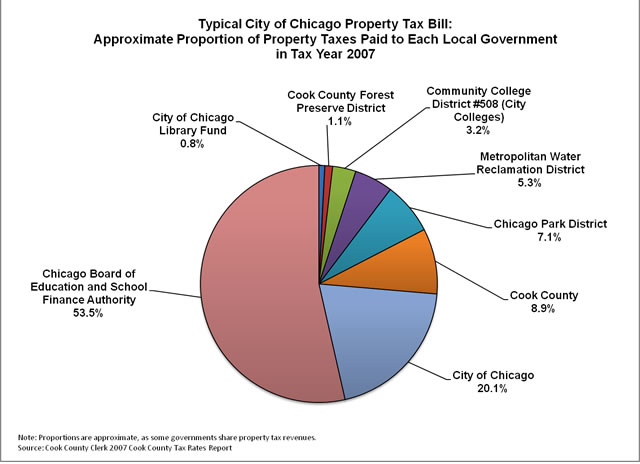

Where Do Your Property Tax Dollars Go The Civic Federation

Property Taxes By State Embrace Higher Property Taxes

Property Tax Comparison By State For Cross State Businesses

About The Cook County Assessor S Office Cook County Assessor S Office

Property Tax Homestead Exemptions Itep

How Taxes On Property Owned In Another State Work For 2022

The Perfect Storm 2021 Property Taxes And Chicago Community Associations The Ksn Blog

Illinois Property Tax Exemptions What S Available Credit Karma Tax

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)